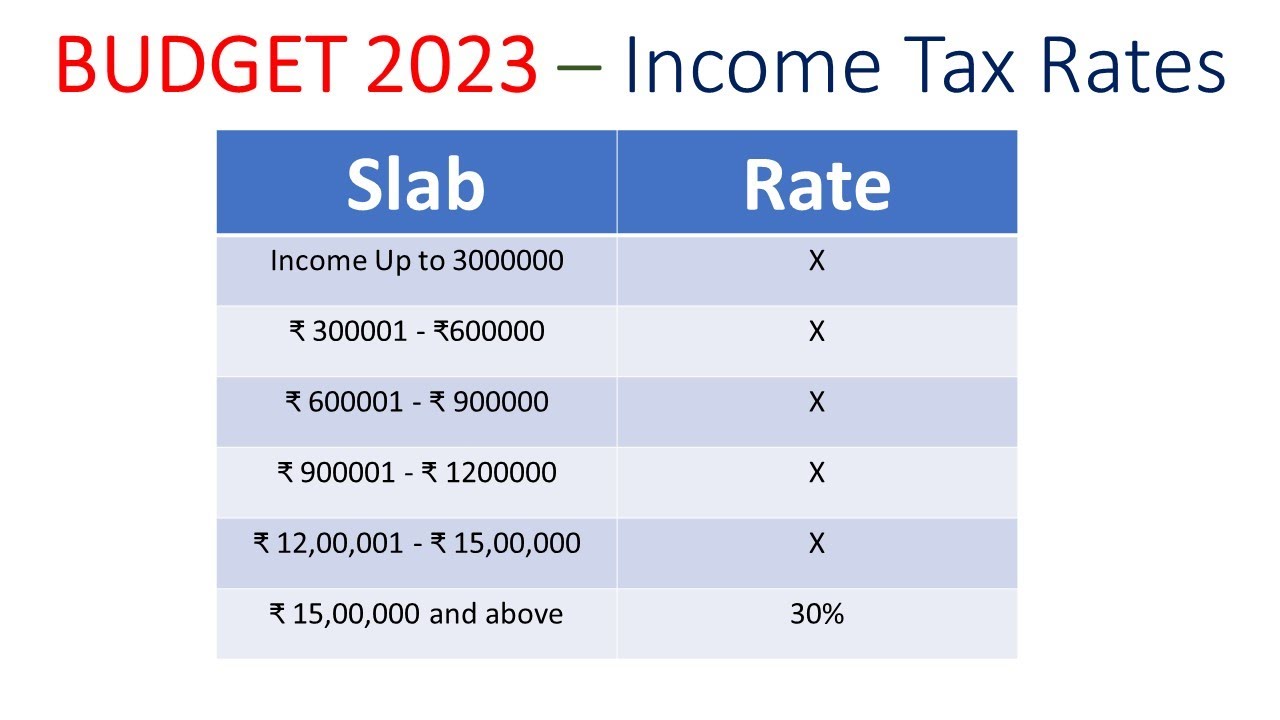

Income Tax Ay 2025-25 Slab. Individuals and hufs can opt for the old tax regime or the new tax regime with lower rate of taxation (u/s 115 bac of the income tax act) the. The finance minister made changes in the income tax slabs under the new tax regime.

In india, income tax is calculated using income tax slabs and rates for the applicable financial year (fy) and assessment year (ay).

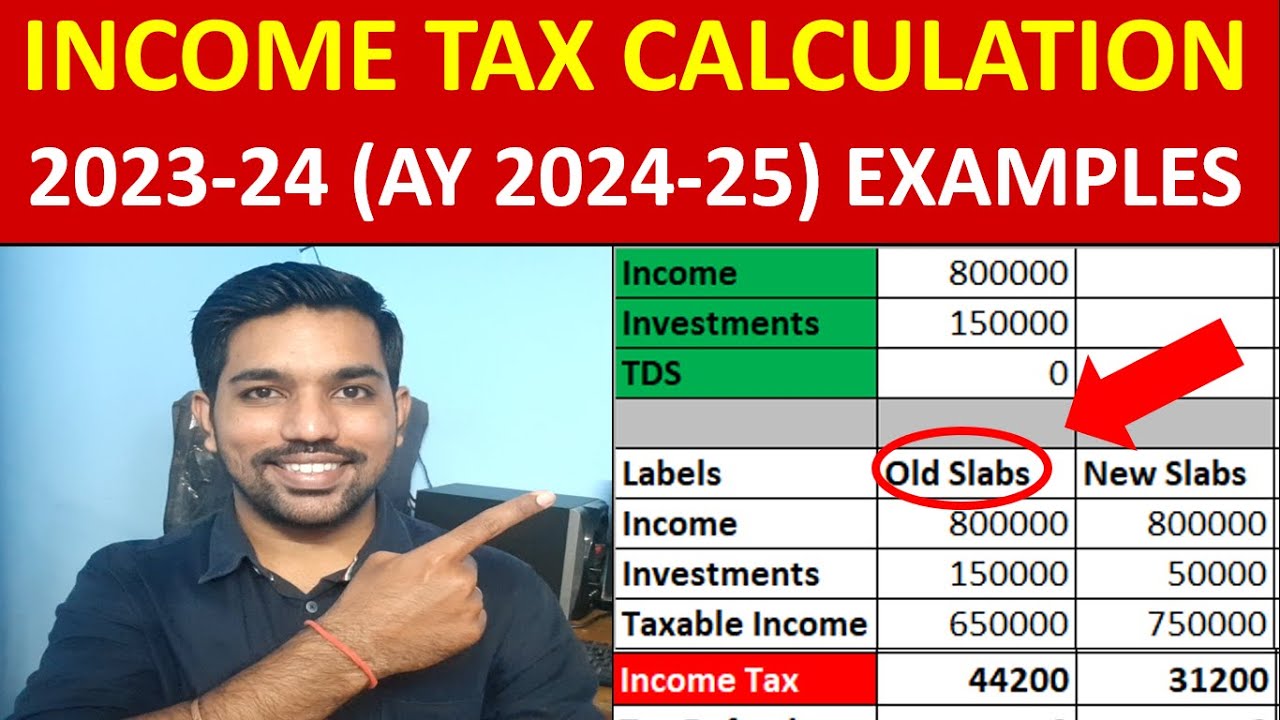

Tax Slab Rate Calculation for FY 202324 (AY 202425) with, Here are some examples of how these rates would apply: An additional 4% health and.

New Tax Slab FY 202324, AY 202425 Old, New Regime, Following are the steps to use the tax calculator: Those opting for the new tax regime can avail lower tax rates depending on the slab.

Tax Slab Rate FY 202324 (AY 202425) in Budget 2025 FM, Individuals and hufs can opt for the old tax regime or the new tax regime with lower rate of taxation (u/s 115 bac of the income tax act) the. Choose the financial year for which you want your taxes to.

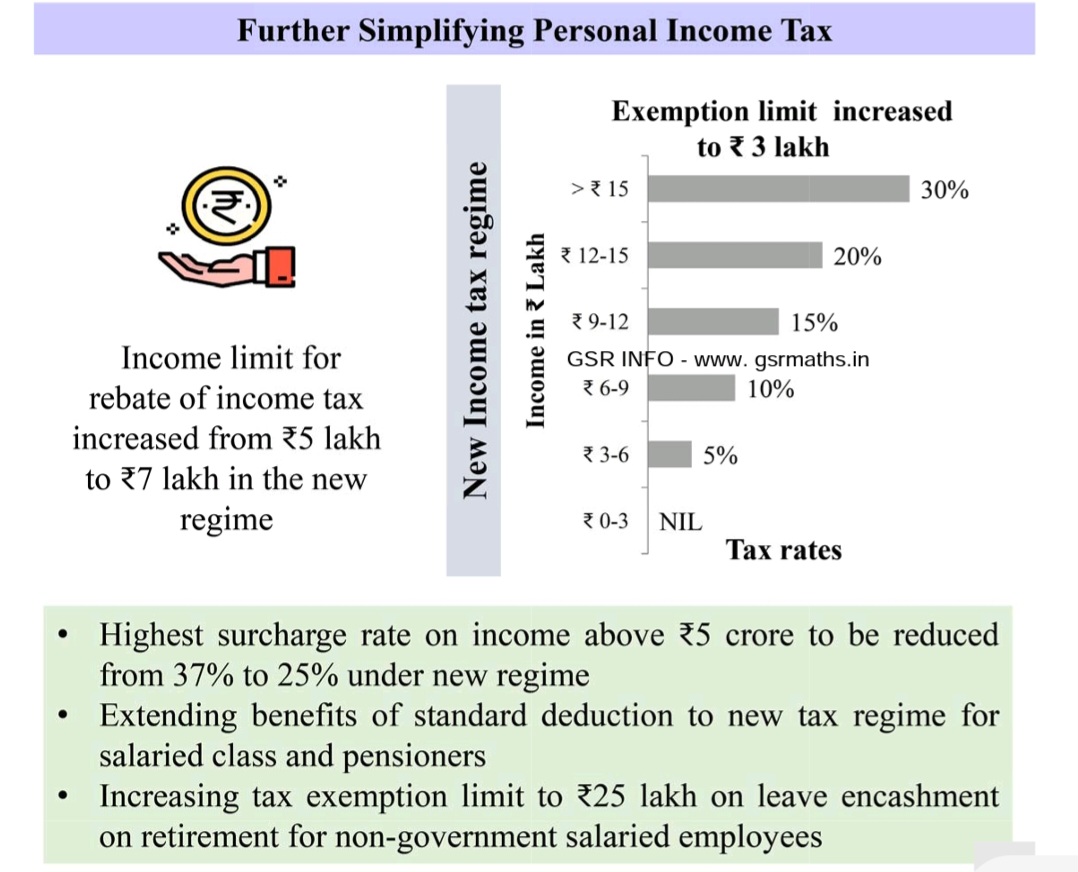

Tax Slabs FY 202324 AY 202425 GSR INFO AP TS Employees, Following are the steps to use the tax calculator: The highest surcharge rate has been reduced from 37% to 25% under the new tax regime.

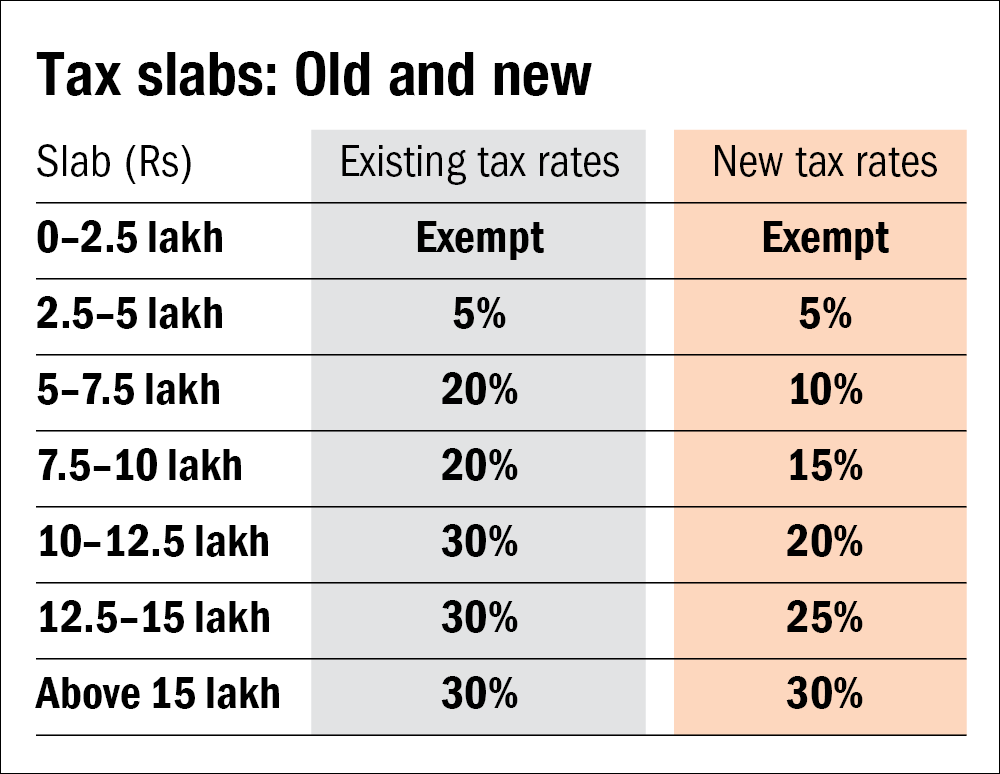

Choosing between the old and new tax slabs Value Research, The highest surcharge rate has been reduced from 37% to 25% under the new tax regime. Individuals and hufs can opt for the old tax regime or the new tax regime with lower rate of taxation (u/s 115 bac of the income tax act) the.

Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax, The changes announced in the income tax slabs under the. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

![Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3RPHIvoGiyFMqYgzPepp7W-yacCgvnB_-QZrpBQqpUEem43puz5Do6OGV4HF7M87pTxpyGfFWOh8KT9mXdn0cASjSTLfRPT4iAxd3HUNAcYFHNLtvdPS0SAwskzdHBY1WJ9hPdoKwsD45ZZ64qc17JyAuzsPHMZCf_iA1JVrepCAanVrfrNtUCvUQ/s16000/Income Tax 2023-24 FY [2024-25 AY] Old & New Tax Slab Rates Online IT 2023-24 Calculator.png)

Tax Slab rates for Fy 202324 Ay 2425 SIMPLE TAX INDIA, The highest surcharge rate has been reduced from 37% to 25% under the new tax regime. 30% of the total income that is more than rs.10 lakh + rs.1,12,500 +.

How to Calculate Tax 202324 (AY 202425) Tax Calculation, Individuals and hufs can opt for the old tax regime or the new tax regime with lower rate of taxation (u/s 115 bac of the income tax act) the. 30% of the total income that is more than rs.10 lakh + rs.1,12,500 +.

Know the New Tax Slab Rates for FY 202324 (AY 202425) by, Income tax rates for fy. Choose the financial year for which you want your taxes to.

Budget 2025 Tax Slabs Explained New tax regime vs Existing new, 20% of the total income that is more than rs.5 lakh + rs.12,500 + 4% cess. In india, income tax is calculated using income tax slabs and rates for the applicable financial year (fy) and assessment year (ay).