Texas Property Tax Increase 2025. The $18 billion compromise between the texas house and senate — which includes more than $5 billion approved for relief in 2025 — would give increased tax. The latest annual omnibus liquor bill in utah increases the markup the state charges for spirits, wine, and malt liquor from.

The 3.65 cent increase is the. The $18 billion compromise between the texas house and senate — which includes more than $5 billion approved for property tax relief in 2019 — would lower.

Despite the property tax relief package recently signed into law by greg abbott, most texas residents are facing higher property taxes and blame the.

Based on preliminary district tax rates released by the texas education agency (tea), a property owner with a home valued at $413,338 (the average price of a texas home in 2025) would save between $731 to $812 in a year under sb 2.

Texas Property Tax Map Printable Maps, According to state law, the taxable value for a homestead cannot increase more than 10 percent a year. The budget increase will lead to property tax increases for meridian residents.

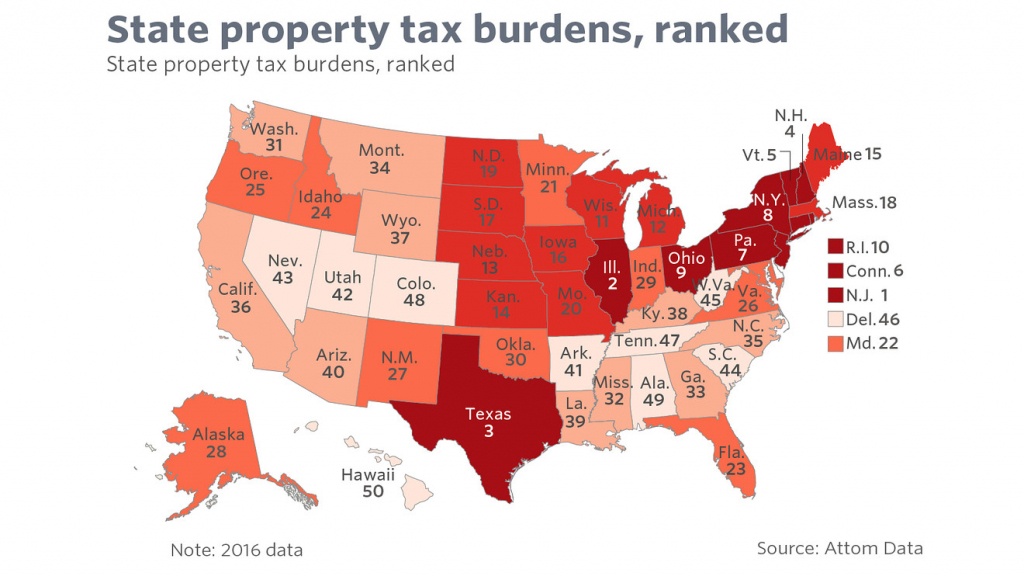

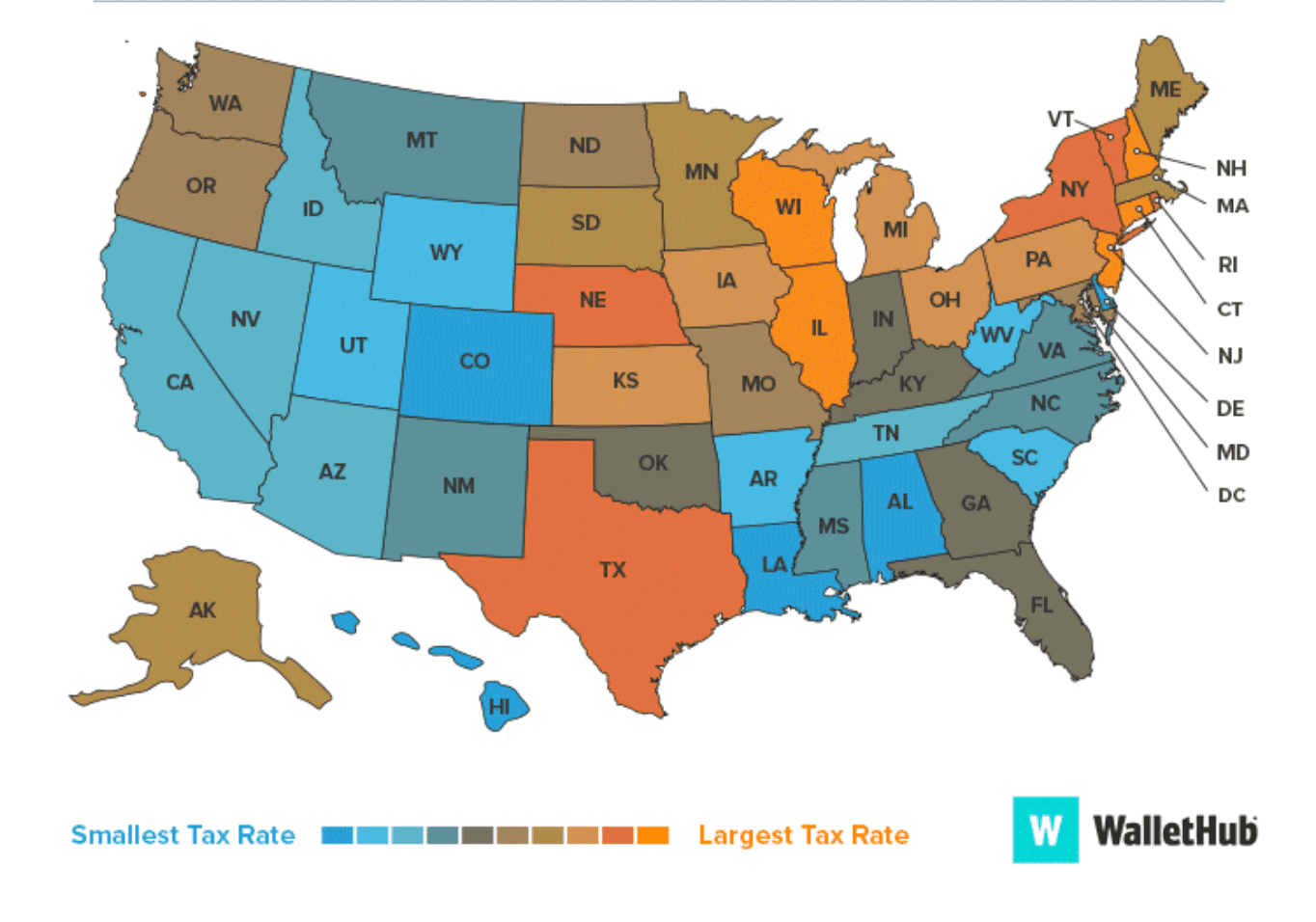

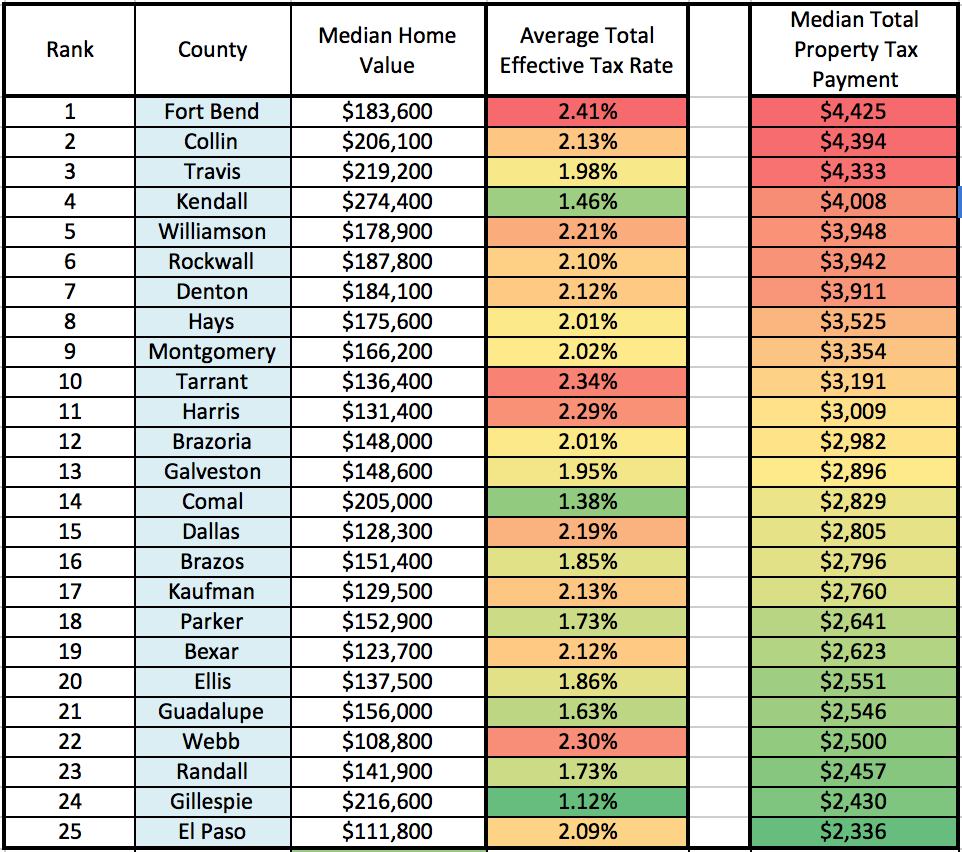

Where Does Texas Rank on Property Taxes? Texas Scorecard, Lufkin — few texans understand the state’s complex property tax laws. The city property tax will.

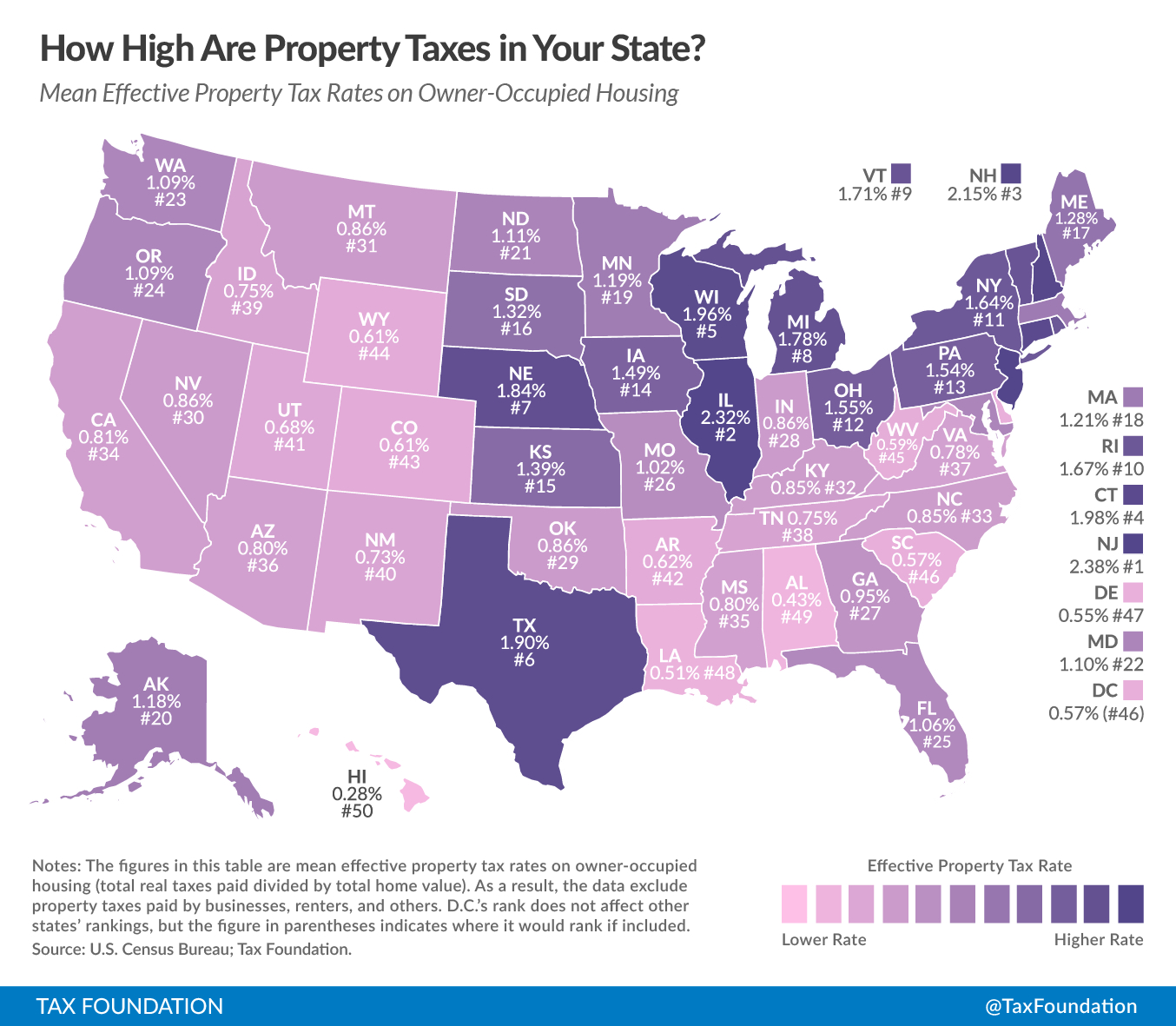

How High Are Property Taxes In Your State? Tax Foundation Texas, Under senate bill 2 and senate bill 3, $18 billion of texas' historic budget surplus will be allocated toward driving down school district property tax rates,. As part of an $18 billion property tax relief package, texas homeowners will see their homestead exemption on their property tax bill increase from $40,000 to.

Property Tax In Texas 2025 Flori Jillane, Austin (kxan) — the texas house passed senate bill 2 on july 13, advancing the property tax relief bill to gov. In the face of another year of rapidly increasing property tax appraisals, and the expiration of a widely used property tax incentive program, the stage was set for the.

Texas Counties Total Taxable Value for County Property Tax Purposes, According to state law, the taxable value for a homestead cannot increase more than 10 percent a year. The 3.65 cent increase is the.

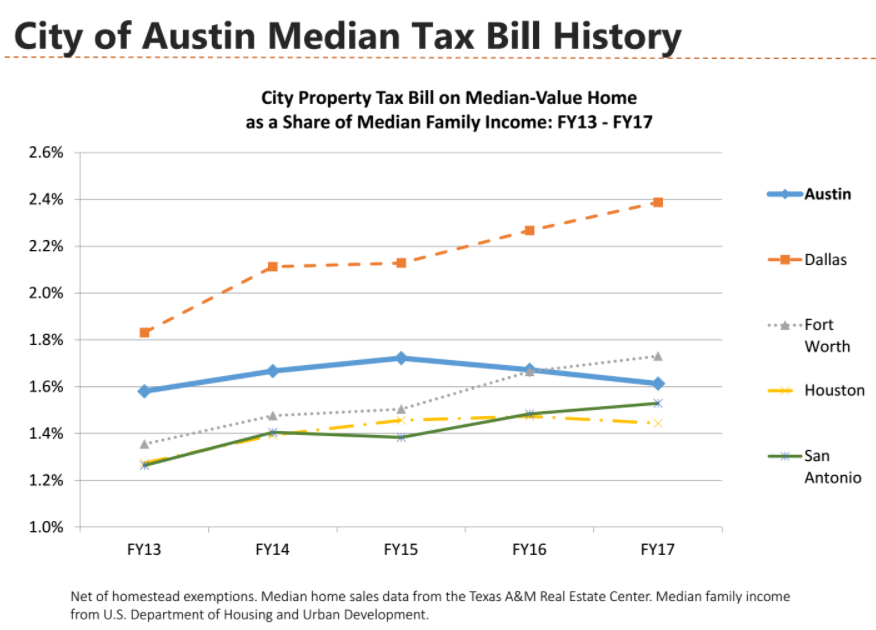

Budget proposal would raise Austin property taxes, increase permitting, In the face of another year of rapidly increasing property tax appraisals, and the expiration of a widely used property tax incentive program, the stage was set for the. Greg abbott for his approval.

Where Do Texans Pay The Highest Property Taxes?, Under senate bill 2 and senate bill 3, $18 billion of texas' historic budget surplus will be allocated toward driving down school district property tax rates,. The city property tax will.

Local leaders at odds with Texas legislative focus on slowing property, Despite the property tax relief package recently signed into law by greg abbott, most texas residents are facing higher property taxes and blame the. Under senate bill 2 and senate bill 3, $18 billion of texas' historic budget surplus will be allocated toward driving down school district property tax rates,.

Texas Has the FifthHighest Property Taxes in the Nation, But Do We Get, That 10 percent cap is why our net appraised value for 2025 is. Lufkin — few texans understand the state’s complex property tax laws.

Biennial Property Tax Report Texas County Progress, The city property tax will. That 10 percent cap is why our net appraised value for 2025 is.

The texas public policy foundation’s taxpayer protection project released its full agenda for the 2025 89th texas legislative session.

Despite the property tax relief package recently signed into law by greg abbott, most texas residents are facing higher property taxes and blame the.